Annual Report 2023

Excellently

Positioned

for Sustainably Profitable Growth

Annual Report 2023

Download PDFSustainability Report 2023

Discover moreInsight into our projects

Discover more

Dear Shareholders, Investors and Interested Parties

With EBIT of CHF 122.6 million, currency-adjusted CHF 126.5, Implenia achieved its target for 2023 in a challenging market environment. Consolidated profit stood at a record level of CHF 141.8 million. This underlines that Implenia is excellently positioned in the market with its strong team and its attractive portfolio of services.

Divisions Real Estate, Buildings, Civil Engineering and Specialties all contributed to the strong Group result, and the order book remains at a high level. Strict application of Value Assurance, Implenia’s risk management, ensures that the projects in the order book have a solid risk and margin profile.

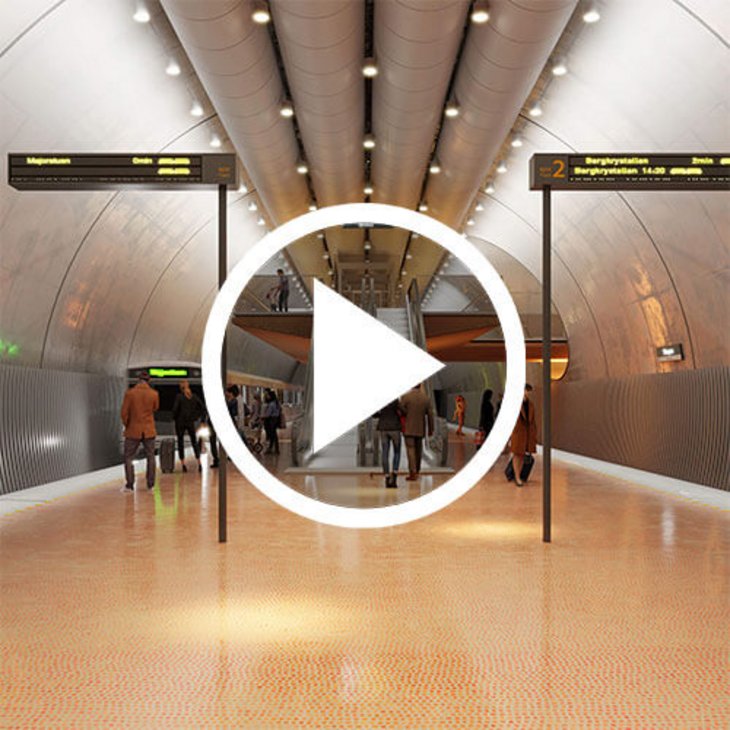

There is still high and rising demand for large-scale real estate projects in attractive urban locations, as well as for complex infrastructure projects. This demand is being stimulated by the megatrends of population growth and urbanisation, as well as by the energy transition and investments in new or modernised transport and energy infrastructure.

With its comprehensive, integrated portfolio of services along the entire value chain and its sector-oriented specialisations (healthcare, research, transport and energy infrastructure, etc.), Implenia is in an outstanding position in these areas.

The portfolio mix of sought-after real estate and infrastructure services enables sustainably profitable growth. By combining organic and inorganic growth, backed by an asset-light strategy, the Group is also tapping into innovative, high-margin business areas.

André Wyss

CEO

Letter from the Chairman of the Board of Directors

Dear Shareholders

Implenia achieved its targets for 2023 and is on track for sustainably profitable growth - underlining that Implenia, with its strong team and comprehensive, integrated portfolio of services, is extremely well positioned in the market. The company's diversified services and extended value chain have paved the way for a strong set of Group results. All the Divisions - Real Estate, Buildings, Civil Engineering and Specialties - contributed to this pleasing outcome.

The order book remains at a high level. Based on its strategic focus and expertise in large, complex real estate and infrastructure projects, the Group was able to win a large number of relevant contracts in 2023. Strict application of Value Assurance, Implenia's risk management, ensures that the projects in the order book have a solid risk and margin profile.

There is still high and rising demand for large-scale real estate projects in attractive urban locations, as well as for complex infrastructure projects. This demand is being stimulated by the megatrends of population growth and urbanisation, the energy transition and investments in new or modernised transport and energy infrastructure. With its comprehensive, integrated portfolio of services along the entire value chain and its sector-oriented specialisations (healthcare, research, transport and energy infrastructure etc.), Implenia is excellently positioned in these areas.

Based on many years of experience, the Group has built up comprehensive capabilities for its differentiated and scalable range of services. Its portfolio mix of sought-after real estate and infrastructure services enables sustainably profitable growth. By combining organic and in-organic growth, backed by an asset-light strategy, the Group is also tapping into innovative, high-margin business areas.

Proven expertise in planning and building sustainable real estate and infrastructure is increasingly in demand from private and public clients, especially for large and complex projects. Implenia aims to shape the transformation towards a more sustainable construction and real estate industry. In 2023, the company's position as an industry leader in sustainability was confirmed by the relevant environmental, social and governance (ESG) ratings.

Implenia wants its shareholders to participate in the company's growing success, so the Board of Directors will propose a dividend of CHF 0.60 per share (previous year: CHF 0.40) to the AGM on 26 March 2024. The Board of Directors anticipates that Implenia will continue to distribute dividends in the future.

On behalf of the Board of Directors, I would like to thank all employees for their hard work during the year, and to thank you for your trust. I look forward to your continued support as a shareholder.

Hans Ulrich Meister

Chairman of the Board of Directors